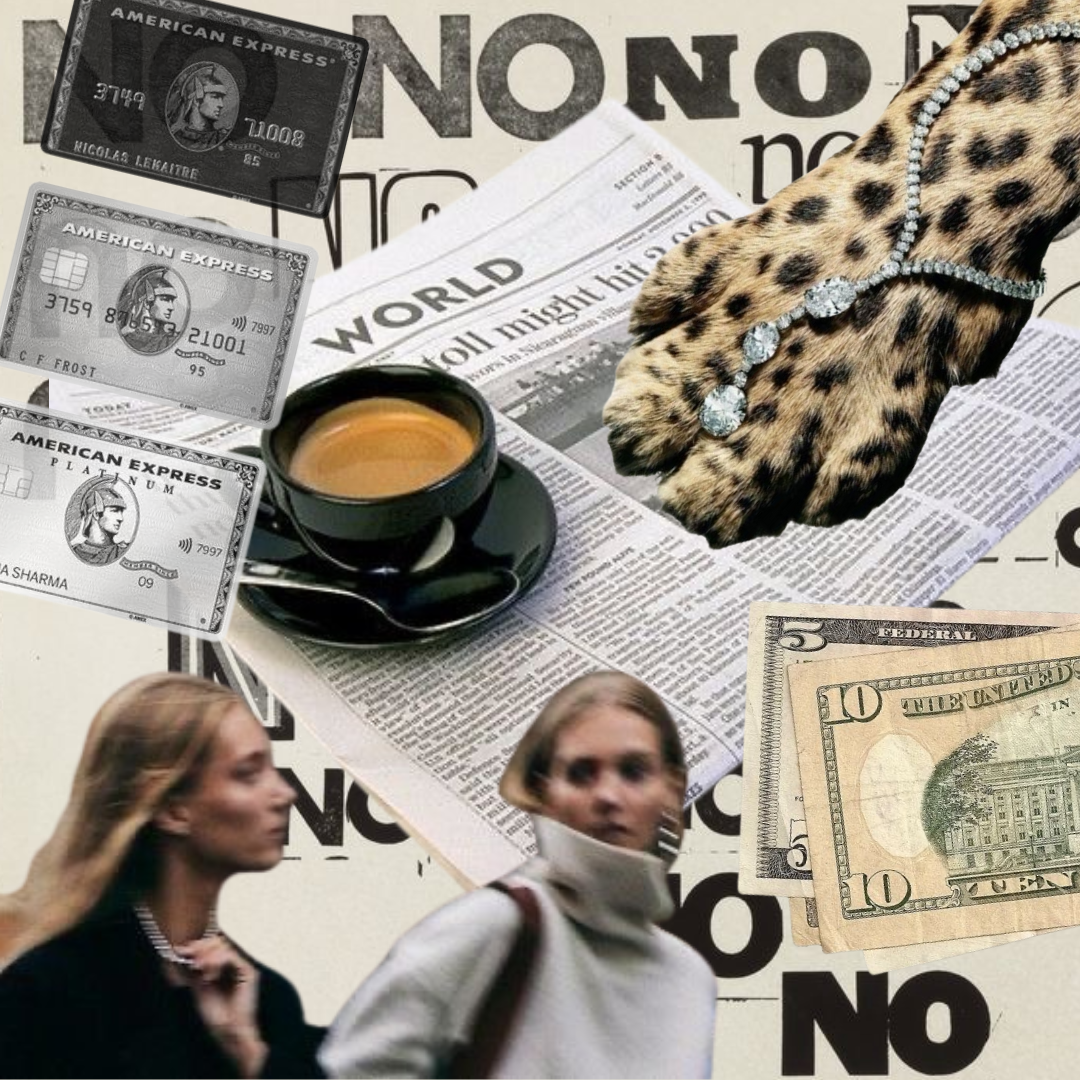

Americans Are Spending Money They Don’t Have

By Katie Walsh

Money is personal. There is a reason we don’t share our salaries with our friends, or casually chat about our credit card bills. We guard our finances and keep them close to our chest. At the same time, most of us are guilty of making it seem like money isn’t an issue. The longer we pretend ignorance is bliss, the more danger we could face down the road.

Now, more than ever, it is crucial for young, working professionals to actively save money. Inflation, rising interest rates, stock market downturns, housing demand, and invasive marketing are just some of the harsh headwinds in this economy. Let’s not forget about unreasonably high rent prices.

For most young Americans, buying a house or a new car are pipe dreams due to high interest rates. Inflation is evident at every grocery run. We are living in a world where charcuterie boards could break the bank.

Our financial realities are—it seems—out of our control. We can point our fingers all day long at the Fed or the president and complain about interest rates and inflation. But at the end of the month, we pay the price of the cost of living.

Where is the fine line between spending and saving? Is an $18 espresso martini worth it when you are forced to pay rent until you are 35.

Maybe I’m being slightly dramatic. But the point is crucial for those in their twenties and thirties.

Saving money isn’t an option anymore. It is a necessity. If you don’t have an emergency fund, a long-term savings plan, or a retirement account, let this be a PSA to start now.

Why? Because history repeats itself. Because next year is an election year. Because interest rates could go down, or interest rates could go up. Because just when we are comfortable with the global economic landscape, it changes in the blink of an eye. All our hard work as young professionals should be protected. Life can be quite unkind. No matter how high you might think your salary is, it doesn’t mean a thing if you aren’t saving money.

Technology has made our generation addicted to immediate gratification. But thinking long-term can make you a force to be reckoned with. Here are three different ways to save that should give you peace of mind.

1. Change your mindset with an emergency fund.

My stomach gets uneasy when I think about losing my job. However, it’s a reality of life. Around six million Americans lose or leave their job every month. We should be saving three to six months for essential expenses in case of unfortunate circumstances. Essentials could include rent, utilities, groceries, car payments, gas, etc. Tally up a monthly estimate and multiply it by six to see the number you should be striving to store in an emergency fund. The number might shock and humble you. It is imperative that we keep this number in the back of our minds when we have the desire to splurge on non-essentials.

2. Be intentional with long-term savings plans.

I would love a traditional brick house overflowing with hydrangeas and a classic white picket fence. Interior walls with Serena & Lilly wallpaper and a kitchen filled with Williams Sonoma. This is my dream – which may be completely different than yours, but regardless, our future goals typically involve lots of dollar signs. And how fun and satisfying would it be to watch our dreams become a reality? The only way this will happen is if we intentionally set aside money.

One of my friends recommended opening a savings account at Ally Bank, because you can separate your savings into different buckets. You can create a travel bucket, a house bucket, a car bucket, etc. Reflect on your goals and start saving! About $100 a paycheck could make a big difference one day.

3. Don’t want to work forever? set up a retirement account.

I know retirement seems like its ions away. But if you have started saving for retirement, your future self is thanking you already. The earlier you start investing, the more you will enjoy the fruits of your labor. And if you are in your twenties or thirties, time is very much on your side. The beauty of compounding interest could literally transform your savings over the years. A Roth IRA is a fantastic retirement account. This is funded with after tax dollars, but when you reach retirement age, you can take money out tax free. Contribution limits are currently $6,500 per year, and you can’t contribute if you make more than $153,000 per year. If you qualify, add this to your October to-do list.

We are constantly told the same message in hundreds of different ways—that we should be living our young adulthood to the fullest. Travel the world, go out on the weekends, buy whatever makes you happy. The world wants us to savor our youth, but at what cost? If we don’t try to find balance now, it will be quite difficult to live up to our expectations of the future.

Katie Walsh is the founder of the k’tea & co, an editorial website that focuses on positive and inspirational media. She works in finance in Cincinnati, Ohio, and you can find more of Katie’s work on @the.ktea.co